| 02 July 2015 | Trinity Securities Company Limited | |

| 12 December 2012 | Asia Plus Securities Public Company Limited | |

| 27 November 2012 | Trinity Securities Company Limited | |

| 13 November 2012 | Phillip Securities (Thailand) Public Company Limited | |

| 13 September 2012 | Phillip Securities (Thailand) Public Company Limited | |

| 14 August 2012 | Asia Plus Securities Public Company Limited | |

| 17 July 2012 | Asia Plus Securities Public Company Limited |

File size: 434 KB. |

File size: MB. |

File size: 693 KB. |

File size: MB. |

File size: 2.53 MB. | File size: 1.66 MB. |

File size: 981 KB.

File size: 1.02 MB. |

File size: 2.82 MB. |

File size: 2.47 MB.

File size: 1.22 MB.

The Summary of extraordinary general meeting of shareholders No. 2/2016

The Summary of extraordinary general meeting of shareholders No. 2/2016

File size: 2.45 MB.

File size: 4.32 MB. | File size: 6.07 MB. |

File size: 6.06 MB. | File size: 6.40 MB. |

| Year | Annual Report | Form 56-1 | |

|---|---|---|---|

| 2020 | |||

| 2019 | |||

| 2018 | |||

| 2017 | |||

| 2016 | |||

| 2015 | |||

| 2014 | |||

| 2013 | |||

| 2012 | |||

| 2011 | |||

| 2010 | |||

| 2009 | |||

| 2008 | |||

| 2007 | |||

| 2006 | |||

| 2005 | |||

| Consolidated financial statements | Separate financial statements | |||||

|---|---|---|---|---|---|---|

2019 | 2018 | 2017 | 2019 | 2018 | 2017 | |

| Profitability Ratio | ||||||

| Yield Rate (%) | 32.59 | 34.57 | 29.15 | 31.75 | 34.81 | 31.20 |

| Interest Rate (%) | 5.18 | 4.93 | 5.48 | 5.10 | 4.89 | 5.42 |

| Net Yield Rate (%) | 27.41 | 29.54 | 23.72 | 26.65 | 29.93 | 25.78 |

| Net Profit Rate (%) | (0.86) | 10.15 | (53.96) | 13.50 | 12.23 | (74.43) |

| Return on Equity (%) | (0.39) | 5.15 | (23.34) | 4.60 | 4.37 | (26.41) |

| Efficiency Ratio | ||||||

| Return on Total Assets (%) | (0.16) | 2.00 | (10.23) | 1.97 | 1.72 | (11.39) |

| Total Assets Turn Over Ratio (Times) | 0.18 | 0.20 | 0.19 | 0.15 | 0.14 | 0.15 |

| Financial Policy Ratio | ||||||

| Ratio of Liability to Equity (times) | 1.27 | 1.53 | 1.51 | 1.16 | 1.52 | 1.57 |

| Ratio of Total Receivable to Loan from (times) | 0.95 | 0.90 | 1.07 | 1.30 | 1.13 | 1.19 |

| Dividend Rate (%) | N/A | N/A | N/A | N/A | N/A | N/A |

| Asset Quality Ratio | ||||||

| Ratio of Allowance for Doubtful Debt to Total Receivable (%) | 23.56 | 21.71 | 19.91 | 9.43 | 7.57 | 4.62 |

| Bad Debt to Total Receivable (%) | 5.30 | 3.93 | 3.39 | 7.64 | 4.83 | 4.30 |

| Ratio of Non performing loan to Total Receivable (%) | 4.99 | 3.81 | 2.55 | 9.29 | 6.75 | 4.78 |

CG Principle

Group Lease received a rating of “Very Good” in the scoring results in the CG Report 2018 by the Thai Institute of Directors (IOD)

The Company received a rating of “Very Good” in the corporate governance scoring results for Thai listed companies of year 2018. Currently, Thai listed companies are evaluated according to 5 main categories derived from the Organization for Economic Corporation and Development (OECD) principles of corporate governance that are Rights of Shareholders, Equitable Treatment of Shareholders, Role of Stakeholders, Disclosure and Transparency and Board Responsibilities.

>> Corporate Governance Committee Charter

>> Risk Management Committee Charter

Rational and Principle:

The Board of Group Lease Public Company Limited (the “Company”) realizes the importance of a business conduct with responsibility, ethical and transparency. Besides good performance and returns, the Company also concerns about conducting business under the corporate governance code as the Company believes that good corporate governance will enhance the sustainable growth of the Company and will enhance maximum value to all stakeholders such as shareholders, employees, suppliers, creditors, customers as well as society as a whole. Therefore, the Board has approved the Corporate Governance Policy with good practices towards the said stakeholders and the Code of Ethics for the Board and for Employees. In addition, the Company shall monitor and ensure the compliance to this Policy. Moreover, the Board also approved the Anti-Corruption Policy to be a part of the Company’s Code of Ethics in order to be a good practice for directors, executives and all employees.

>> Corporate Governance Policy:

>> Best Practice towards Stakeholders:

>> Code of Ethics for Board of Directors

>> Code of Ethics for Employees

>> Monitoring

>> Disciplinary

This Business Code of Ethics (Amended no. 1) is effective on 17 March, 2020

| Date | Event |

| 3 August 2020 | AGM 2020 |

| Date | Event |

| 23 April 2019 | AGM 2019 |

| Date | Event |

| 26 April 2017 | AGM 2017 |

| Date | Event |

| 6 December 2016 | EGM 2/2016 |

| 24 June 2016 | EGM 1/2016 |

| 23 May 2016 | แถลงข่าว GL จับมือ J Trust Asia รุกธุรกิจดิจิทัลไฟเเนนซ์ในภูมิภาคอาเซียน |

| 13 May 2016 | แถลงข่าว GL โชว์กำไรทุบสถิติทำ new high ชู vision ผู้นำดิจิทัลไฟเเนนซ์ในอาเซียน |

| 28 April 2016 | AGM 2016 |

| 15 February 2016 | แถลงข่าว GL รุกใหญ่ตลาด CLMV+I ทุบสถิติกำไร |

| 15 February 2016 | Analyst Briefing |

| Date | Event |

| 10 November 2015 | Analyst Briefing |

| 14 August 2015 | Analyst Briefing |

| 27 April 2015 | AGM 2015 |

| 13 February 2015 | Analyst Briefing |

| Date | Event |

| 19-25 February 2014 | Exercise period of GL-W3 (No. 2) |

| 22-28 January 2014 | Exercise period of GL-W3 (No. 1) |

| Date | Event |

| 18-24 December 2013 | Exercise period of GL-W2 (No. 5) |

| 8 November 2013 | Extraordinary General Meeting No. 1/2013 |

| 19-25 September 2013 | Exercise period GL-W2 (No. 4) |

| 17 September 2013 | Signing Ceremony with KBANK |

| 5 September 2013 | Signing Ceremony with Siam Kubota Corp. |

| 27 August 2013 | Analyst Meeting |

| 19-25 June 2013 | Exercise period GL-W2 (No. 3) |

| 26 April 2013 | AGM 2013 |

| 26 April 2013 | Analyst Meeting |

| 20-26 March 2013 | Exercise period GL-W2 (No. 2) |

| Date | Event |

| 11 December 2012 | Opportunity Day |

| 25 October 2012 | The Extraordinary General Meeting of Shareholders No. 2/2012 |

| 12 September 2012 | The Extraordinary General Meeting of Shareholders No. 1/2012 |

| 27 April 2012 | The Annual General Meeting of Shareholders 2012 |

| X-Date | Sign | Benefit Detail |

|---|---|---|

| 30 June 2020 | XM | Book Closing Date : – Record Date : 01 Jul 2020 Meeting Date : 03 Aug 2020 10:00 Agenda : Omitted dividend payment Type of Meeting : AGM Venue : Miracle Grand Convention Hotel, Magic 2 Room, 2nd floor, No. 99 Kamphaeng Phet 6 Rd, Laksi, Bangkok 10210 |

| 01 April 2019 | XM | Book Closing Date : – Record Date : 02 Apr 2019 Meeting Date : 23 Apr 2019 10:00 Agenda : Omitted dividend payment Type of Meeting : AGM Venue : Miracle Grand Convention Hotel, Magic 2 Room, 2nd floor, No. 99 Kamphaeng Phet 6 Rd, Laksi, Bangkok 10210 |

| 29 March 2018 | XM | Book Closing Date : – Record Date : 30 Mar 2018 Meeting Date : 26 Apr 2018 10:00 Agenda : Omitted dividend payment,Changing the director(s) Type of Meeting : AGM Venue : Miracle Grand Convention Hotel, Magic 2 Room, 2nd floor, No. 99 Kamphaeng Phet 6 Rd, Laksi, Bangkok 10210 |

| 04 May 2017 | XD | Book Closing Date : 11 May 2017 Payment Date : 25 May 2017 00:00 Dividend per Share(Baht) : – Operation Period : 01 Jan 2016 – 31 Dec 2016 Source of Dividend : Net Profit Remark |

| 30 Mar 2017 | XM | Book Closing Date : 04 Apr 2017 Meeting Date : 26 Apr 2017 10:00 Agenda : Dividend payment Type of Meeting : AGM Venue : The Miracle Grand Convention Hotel, Grand BC, 4th floor, No. 99 Kamphaeng Phet 6 Rd, Laksi, Bangkok 10210 |

| 10 Nov 2016 | XM | Book Closing Date : 15 Nov 2016 Meeting Date : 06 Dec 2016 10:00 Agenda : Capital increase,Acquisition and disposition of assets,Connected transaction,The issuance of convertible securities,1. Amendment of use of proceeds from the previously issued convertible debenures2. Amendment of Articles of Associations Type of Meeting : EGM Venue : The Miracle Grand Convention Hotel, Magic 2 Rm, 2nd fl, No. 99 KamphangPetch 6, Laksi, Bangkok 10210 |

| 30 Jun 2016 | XW | Book Closing Date : 06 Jul 2016 Subscription Period : Price : – Ratio (Holding:New) : 9 : 1 Condition : – Remark |

| 27 May 2016 | XM | Book Closing Date : 01 Jun 2016 Meeting Date : 24 Jun 2016 09:00 Agenda : Capital increase,The issuance of convertible securities Type of Meeting : EGM Venue : Miracle Grand Convention Hotel, Grand A Room, 4th floor No. 99 Kamphang Phet 6 Lak si Don Muang Bangkok 10210 |

| 09 May 2016 | XD | Book Closing Date : 12 May 2016 Payment Date : 26 May 2016 00:00 Dividend per Share(Baht) : 0.156 Operation Period : 01 Jan 2015 – 31 Dec 2015 Source of Dividend : Net Profit Remark |

| 28 Mar 2016 | XM | Book Closing Date : 31 Mar 2016 Meeting Date : 28 Apr 2016 10:00 Agenda : Dividend payment,The issuance of debentures Type of Meeting : AGM Venue : Miracle Grand convention Hotel, Magic 2 Rm, 2nd fl., No. 99 Khampang Phet 6, Lak si, Don Muang, Bangkok 10210 |

| 07 May 2015 | XD | Book Closing Date : 12 May 2015 Payment Date : 26 May 2015 00:00 Dividend per Share(Baht) : 0.0625 Operation Period : 01 Jan 2014 – 31 Dec 2014 Source of Dividend : – Remark |

| 25 Mar 2015 | XM | Book Closing Date : 30 Mar 2015 Meeting Date : 27 Apr 2015 13:00 Agenda : Dividend payment Type of Meeting : – Venue : Ballroom 1 Room, 3rd fl., The Emerald Hotel-Bangkok, No. 99/1, Rachadapisek Rd.,Din Daeng, Bangkok 10320 |

| 08 May 2014 | XD | Book Closing Date : 14 May 2014 Payment Date : 28 May 2014 00:00 Dividend per Share(Baht) : 0.0568 Operation Period : 01 Jul 2013 – 31 Dec 2013 Source of Dividend : – Remark |

| General Information | ||

|---|---|---|

| Company Name | : | Group Lease Public Company Limited (GL) |

| Location | : | 63 Soi 1 Thetsabannimitrtai Road,Ladyao, Chatuchak, Bangkok 10900. |

| Core Business | : | Hire purchase Business and Holding entity |

| Registration Number | : | 0107537000327 (old number Bor Mor Jor. 279) |

| Telephone | : | +662 (0) 2580-7555 |

| FaX | : | +662 (0) 2954-2902-3 |

| Home Page | : | www.grouplease.co.th / grouplease.international |

| : | [email protected] / [email protected] | |

| Registered Capital | : | 922,545,040.00 Baht divided into 1,845,090,080 ordinary shares at 0.50 Baht par value |

| Paid-up Capital | : | 762,769,079 Baht divided into 1,525,538,158 ordinary shares (as of 30 December 2019) |

| Free Float As of 02/04/2019 | |

|---|---|

| Minor Shareholders (Free float) | 7,384 |

| % Shares in Minor Shareholders (% Free float) | 37.03 |

Remark: Updated as of the latest book closing date.

| Overview As of 01/07/2563 Rights Type : XM | |

|---|---|

| Total Shareholders | 7,675 |

| % Shares in Scripless Holding | 90.02 |

| Rank | Major Shareholders | # Shares | % Shares |

|---|---|---|---|

| 1. | ENGINE HOLDINGS ASIA PTE. LTD. | 402,565,553 | 26.39 |

| 2. | บริษัท ไทยเอ็นวีดีอาร์ จำกัด | 260,366,444 | 17.07 |

| 3. | SIX SIS LTD | 185,852,842 | 12.18 |

| 4. | Mr. Koji Ito | 161,788,541 | 10.61 |

| 5. | UOB KAY HIAN PRIVATE LIMITED | 102,450,000 | 6.72 |

| 6. | บริษัท ศูนย์รับฝากหลักทรัพย์ (ประเทศไทย) จำกัด เพื่อผู้ฝาก | 73,017,803 | 4.79 |

| 7. | นาย เจษฎา เลิศนันทปัญญา | 33,356,200 | 2.19 |

| 8. | CITIBANK NOMINEES SINGAPORE PTE LTD-THAI FOCUSED EQUITY FUND LTD | 31,825,440 | 2.09 |

| 9. | นาง โสภา พฤกษ์ดำรงชัย | 10,647,600 | 0.7 |

| 10. | SOUTH EAST ASIA UK (TYPE C) NOMINEES LIMITED | 9,292,096 | 0.61 |

| Title | Download |

| Minutes of the Annual General Meeting 2025 | |

| Minutes of the 2025 Annual General Meeting of Shareholders | |

| Notice of the 2025 Annual General Meeting (Invitation) | |

| Invitation for the Annual General Meeting of Shareholders FY 2025 | |

| Copy of the Minutes of the Annual General Meeting of Shareholders FY2024 | |

| Profile of Directors who will retire by rotation and to be re-elected | |

| Proxy | |

| |

| |

| The Company’s Articles of Association in relation to the AGM | |

| Identification Documents of shareholders and proxies | |

| Guideline for attending the meeting to protect the outbreak of Coronavirus 2019 (COVID-19) | |

| QR code downloading procedure for Annual Report | |

| Map of the Meeting venue | |

| Agenda Proposal | |

| Annual General Meeting Agenda Proposal 2025 | |

In considering the dividend payment, other factors such as The Company’s operating result, financial position and liquidity should also be taken into the consideration. Payment of dividend has to be considered and approved by the shareholders. However, the Board of Directors is able to approve interim dividend payment and the shareholders shall be acknowledged in the next shareholders’ meeting.

Dividend policy of the Company’s subsidiary is to pay dividend from the net profit from the operating result after tax and other legal reserves. The Board of each subsidiary shall consider from the profit from operating result, financial condition and fund requirement and propose to the shareholder for dividend payment approval.

| Board Date | X-Date | Payment Date | Dividend Type | Dividend (Baht/Share) | Operation Period |

|---|---|---|---|---|---|

| 17/03/20 | – | – | No Dividend | 0.00 | 01/01/19-31/12/19 |

| 18/03/19 | – | – | No Dividend | 0.00 | 01/01/18-31/12/18 |

| 16/03/18 | – | – | No Dividend | 0.00 | 01/01/17-31/12/17 |

| 20/03/17 | 05/05/17 | 25/05/17 | Cash Dividend | 0.274 | 01/01/16-31/12/16 |

| 15/03/16 | 09/05/16 | 26/05/16 | Cash Dividend | 0.1560 | 01/01/15-31/12/15 |

| 06/03/15 | 07/05/15 | 26/05/15 | Cash Dividend | 0.0625 | 01/01/14-31/12/14 |

| 24/03/14 | 08/05/14 | 28/05/14 | Cash Dividend | 0.0568 | 01/07/13-31/12/13 |

| 27/08/13 | 12/09/13 | 25/09/13 | Cash Dividend | 0.11 | 01/01/13-30/06/13 |

| 12/03/13 | 03/05/13 | 23/05/13 | Cash Dividend | 0.1020 | 01/01/12-31/12/12 |

| 12/03/13 | 03/05/13 | 23/05/13 | Stock Dividend | 5.4466230936 : 1 | 01/01/12-31/12/12 |

| 12/03/13 | 26/03/13 | 11/04/13 | Cash Dividend | 1.00 | 01/01/12-30/09/12 |

| 22/08/12 | 05/09/12 | 20/09/12 | Cash Dividend | 1.45 | 01/01/12-30/06/12 |

| 13/02/12 | No Dividend | 0.00 | 01/01/11-31/12/11 | ||

| 13/02/12 | 24/02/12 | 09/03/12 | Cash Dividend | 0.64 | 01/07/11-30/09/11 |

| 14/09/11 | 03/10/11 | 13/10/11 | Cash Dividend | 1.67 | 01/01/11-30/06/11 |

| 04/03/11 | 26/04/11 | 12/05/11 | Cash Dividend | 0.89 | 01/10/10-31/12/10 |

| 09/12/10 | 20/12/10 | 30/12/10 | Cash Dividend | 1.50 | 01/04/10-30/09/10 |

| 16/06/10 | 05/07/10 | 15/07/10 | Cash Dividend | 0.86 | 01/01/10-31/03/10 |

| 17/02/10 | 27/04/10 | 13/05/10 | Cash Dividend | 0.70 | 01/10/09-31/12/09 |

| 11/11/09 | 24/11/09 | 09/12/09 | Cash Dividend | 0.70 | 01/01/09-30/09/09 |

| 10/07/09 | 21/07/09 | 30/07/09 | Cash Dividend | 0.84 | 01/07/08-31/12/08 |

| 22/04/09 | No Dividend | 0.00 | |||

| 21/08/08 | 02/09/08 | 19/09/08 | Cash Dividend | 0.25 | 01/01/08-30/06/08 |

| 25/02/08 | 08/04/08 | 02/05/08 | Cash Dividend | 1.50 | 01/01/07-31/12/07 |

| 2020 | |||

|---|---|---|---|

| Annual Report | Form 56-1 | Financial Statement | Download All |

| Q1 Q2 Q3 | |||

| 2019 | |||

|---|---|---|---|

| Annual Report | Form 56-1 | Financial Statement | Download All |

| 2019 | 2019 | Q1 Q2 Q3 Q4 | Download |

| 2018 | |||

|---|---|---|---|

| Annual Report | Form 56-1 | Financial Statement | Download All |

| 2018 | 2018 | Q1 Q2 Q3 Q4 | Download |

Welcome to Group Lease Public Company Limited email alert service. Our systems will automatically send you Company Announcements and SET Announcements on Group Lease Public Company Limited.

Please fill up your details below to receive email alerts.

[mailpoet_form id=”1″]

There are about 2.5 billion people in the world who lack access to finance. They work in agriculture, fishing, or operate small shops in rural areas in emerging countries. They need investments to improve their lives. For example to expand their shops, to own transportation allowing them to travel to more cities to sell their agricultural products, and to obtain lights and electricity so their children can study even without sunlight.

We would like to provide them small, but very big and meaningful loans, to them. We provide funds needed to grow the “Emerging Consumers” and “Emerging Enterprises” in the “Grass Roots Economy”. This is our original and still current mission for our digital finance business.

The lady in the picture is a Cambodian. Her family has lived together in the same village for more than 100 years. She was in desperate need of solar panels so that her grandchildren can study, however there was no bank or finance company in the village and she was refused financing in the nearest city because she did not have any income verification and thus was considered to be “not credible”. At last, she was about to borrow money from local loan sharks but instead Grouplease provided financing to her.

The finance is how to give credits to strangers.We Group lease run credit checks in a unique wAt Grouplease, we run credit checks in a unique way and have established own risk management system that allows us to provide credit to the 2.5 billion people who lack access to finance to improve their lives. This is our mission.

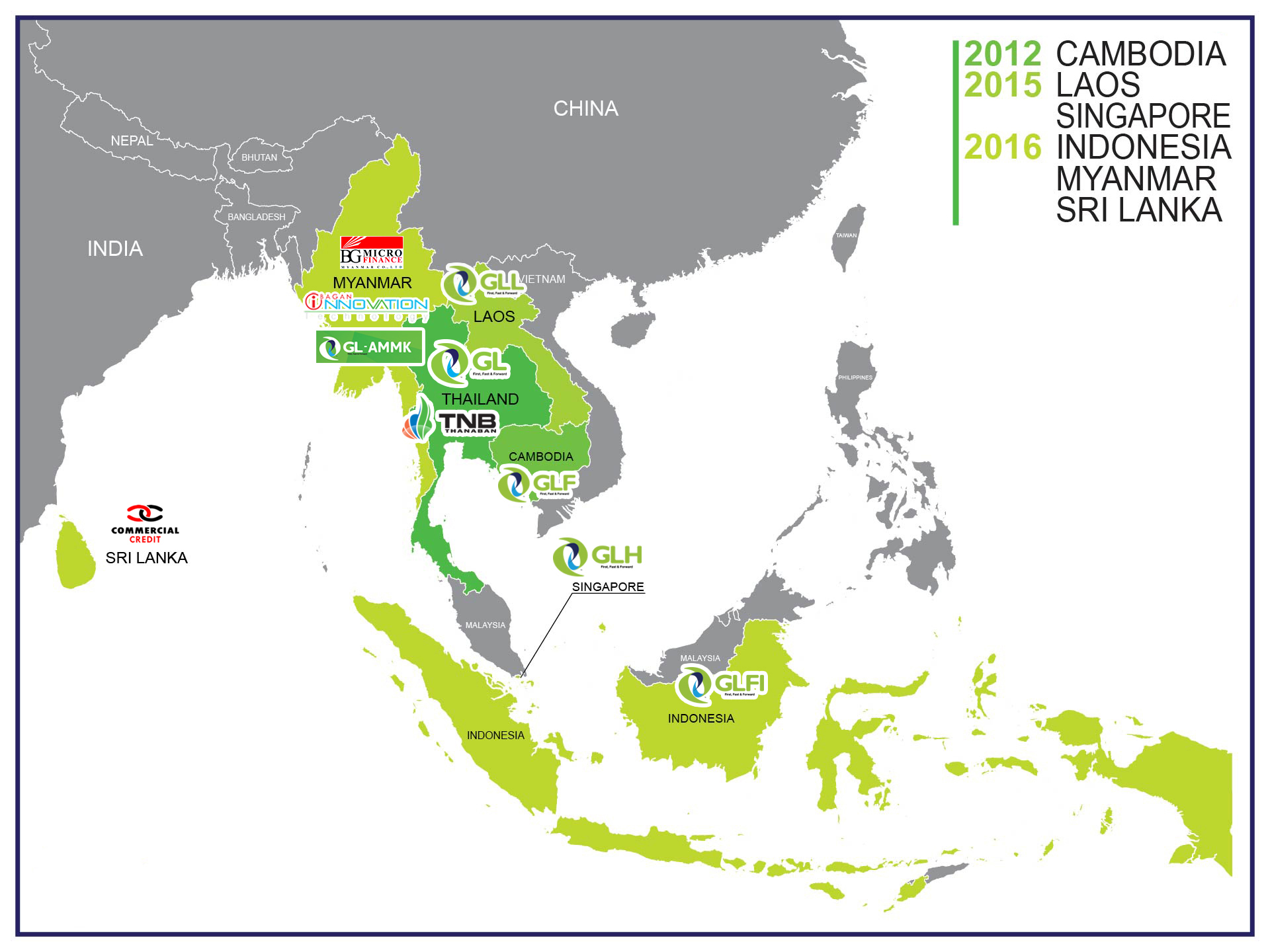

In 2011 we expanded to Cambodia when there was no law allowing leasing and in 2012 became the “First” company to receive a leasing business license after financial leasing law was established. Since then, we have expanded faster than anyone else. We are “Fast” and open new POS every 3 days. We are also “Forward” thinking and are expanding this new finance model developed in Cambodia to all over the world.

Global

First, we are global. We have full operations in 6 countries while others operate only in their home country.

Rural

Second, we focus on rural areas where 2.5 billion people who lack access to finance live. Others focus on cities where doing business is convenient and everything is easily accessible.

Digital

Third, “Digital”. We have developed our own IT system for people at “Emerging Grass Roots” economy and keep updating it every day.

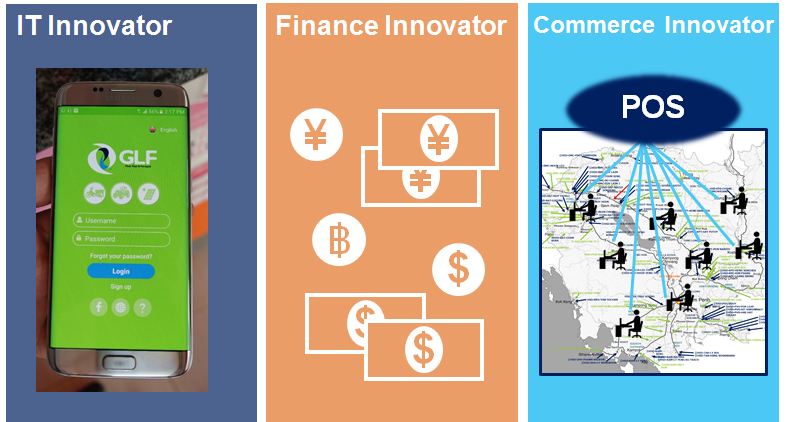

We call our business “Digital Finance” which are composed of IT network, Finance method and Commerce (POS) network.

We call our business “Digital Finance” which are composed of IT network, Finance method and Commerce (POS) network.

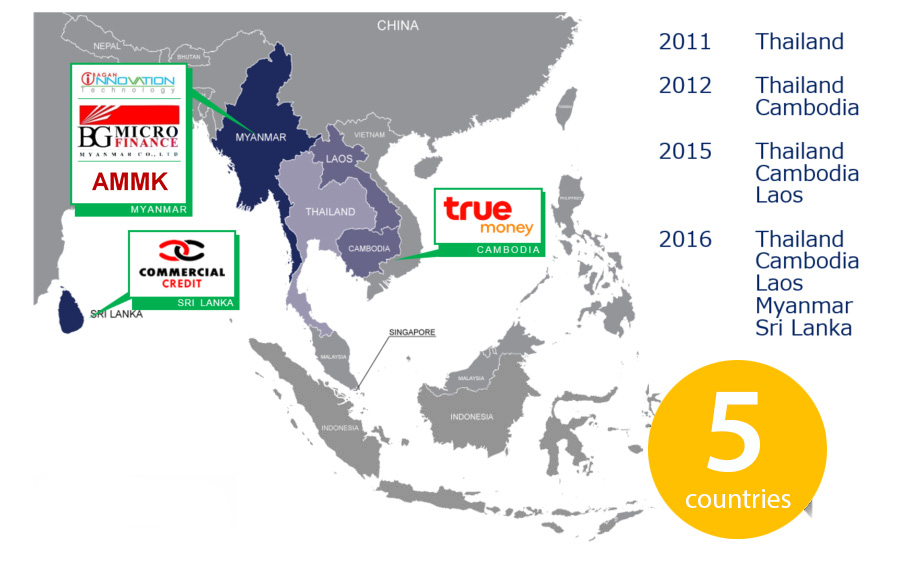

At the end of 2015, we were in only 3 countries: Thailand, Cambodia and Laos. In 2016, we have full-scale operations in 6 countries and with every country profitable. In Indonesia, we achieved profitability in very first quarter after receiving our business license. No other finance company can perform faster than that.

* Recorded more than USD $30 million in Net Income * |

The key focus for our finance business is controlling bad debts. It is very important to select customers who will pay on time to control the bad debts.

The important point of screening is to “Know Your Customer (KYC)”. We focus on understanding our customer’s real information. At screening, our staff visit all customers house by motorcycle. Our staff interview each customer at his or her house, confirm its location and the customer’s background, and interview the neighbors to reconfirm the information.

Typical finance companies focus on documents, having their staff to collect and check papers. However, our target “Emerging Grass Roots” customers do not have such documents, so we cannot screen via documents. Additionally, it is very common in our emerging markets that documents are old and inaccurate and therefore do not provide us with true information. We control our bad debts ratio, very low compared to peers, by our own screening system.

Our staff key in and send useful and true information through our original application to headquarter in real-time. Our country headquarters can then make a decision in a couple of hours based on the in-person collected information. Our method provide us with a fast and efficient screening.

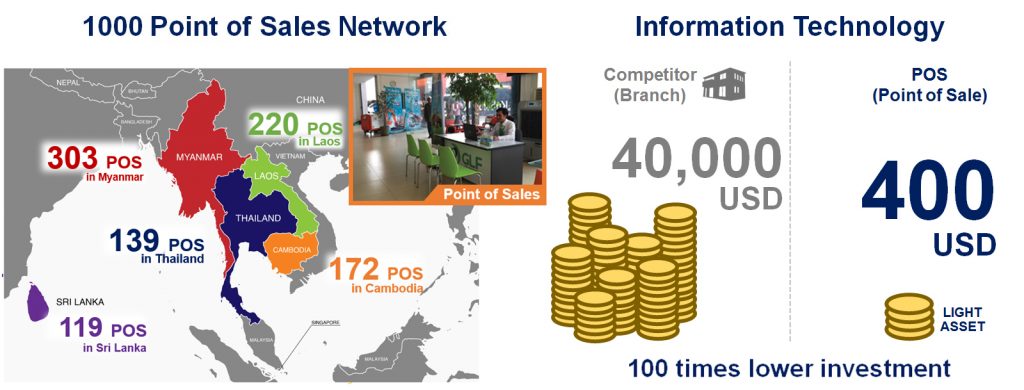

This is our basic business unit: one table, a few chairs, one computer, one smart phone and one or two staff.

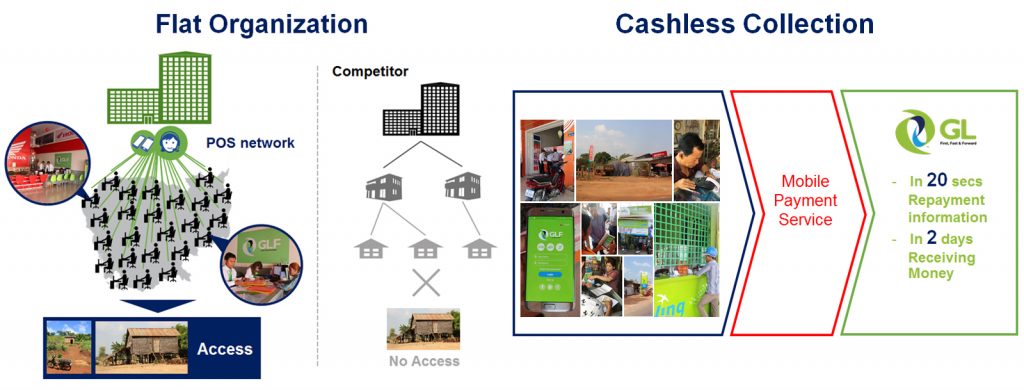

The investment amount per one unit of POS is about USD $400. The low cost explains why we can expand so quickly in rural areas. We do not have Managers at our POS but instead connect each one directly to our local headquarters. Alternatively, other finance companies set up attractive but expensive branches with offices, air-conditioning, electricity and many other facilities. This system has huge cost and speed differences compared to ours. Our “flat structure without middle cost” allows us to expand as fast as opening 100 POS in half a year while other finance companies “hierarchy structure with big middle management costs” prevents them from doing so.

To accelerate our expansion, we are forming alliances with companies in different fields who already have POS networks. For example, we can provide finance via their POS and through their agents. We can achieve this because we have our original IT system.

We will connect with all current dealers and partners networks. Our partners, TrueMoney, which has about 5,000 agents in Cambodia, and AMK Consortium, which has about 22,000 retail shops in Myanmar, will be connected through our original IT system

These dealers become our dealers who introduce “Emerging Consumers” to us and become our clients as “Emerging Enterprises” at the same time.

At the end of 2015, we had about 1,000 dealers.

At the end of 2016, we had more than 50,000 dealers.

At the end of 2015, we had about 200 thousand contacting customers.

At the end of 2016, we had about 20 million potential contacting customers.

High-speed expansion and small investments, these are the strong points of our Digital Finance.

10 million shops and 100 million customers in 2018.

We are IT company and also a finance company. We have expandability like an IT company, monetizing ability like finance company and real points of contact to reach customers in rural areas. We can sell any products and serve any kinds of business. This is our Digital Finance business.

Continue to lead IT Innovation

Continue to lead Finance Innovation

Continue to lead Commerce Innovation

Digital Platform for Billions of People.

Digital Platform for Millions of Products.